Why Invest in Real Estate?

- R&D Accountants

- Aug 14, 2020

- 2 min read

It has been common practice for most middle-class families to invest, or aspire to invest, in a residential rental property. Something that people have picked up from their parents or the media, as a must-have asset.

But why do so many people lean towards property as a go-to investment class? Here are a few reasons we think why.

Cashflow - real estate provides a constant cashflow in the form of rent, which helps service the debt and cover operating expenses; and if the property was bought right, it usually leaves some spare change in the investor's pocket.

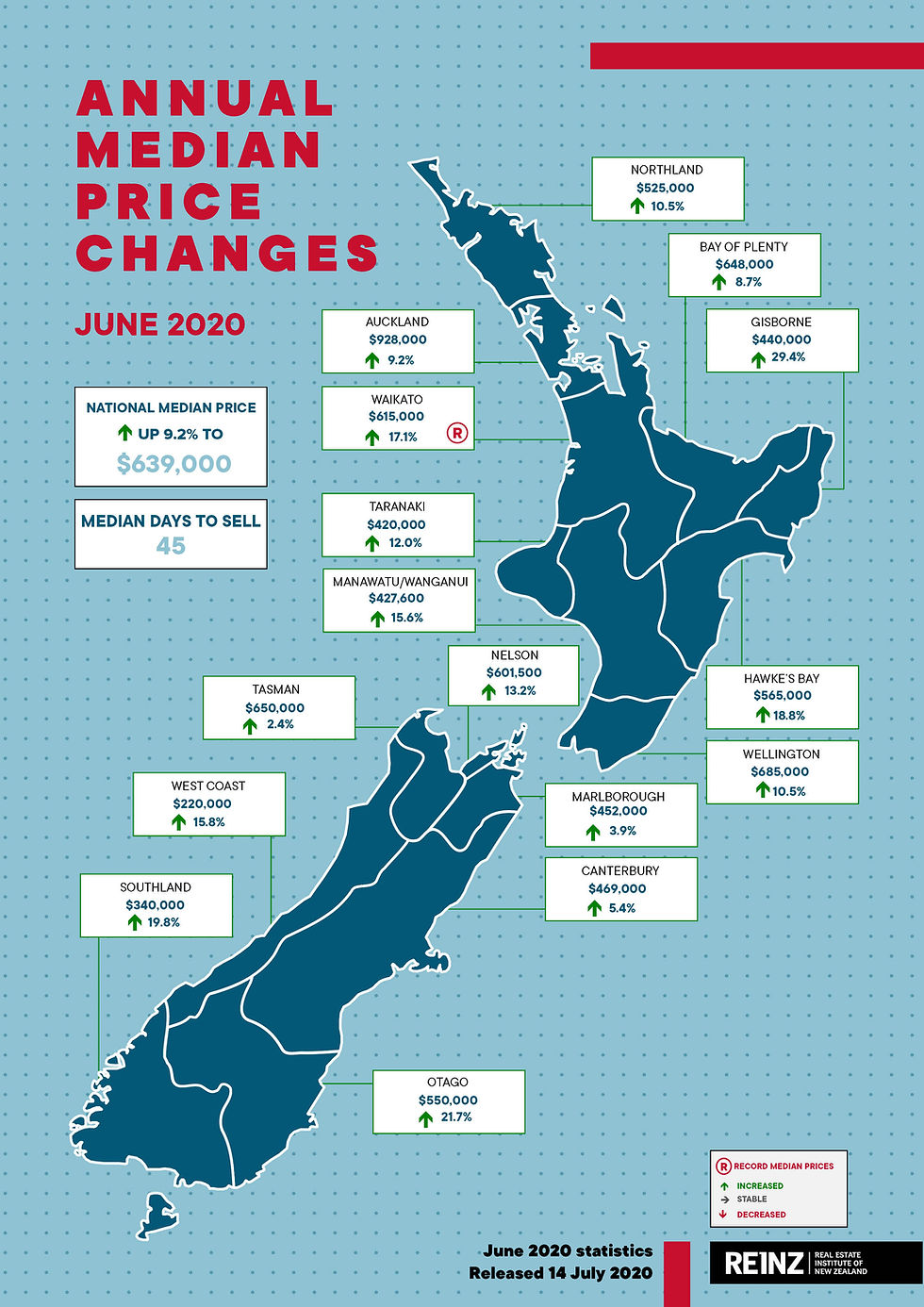

Capital growth - real estate, particularly in New Zealand, provides strong, consistent capital appreciation. As shown in the chart below, median house prices in NZ went up by 9.2% in the 12 months to June 2020. Based on that maths, a $1,000,000 house would be worth $1,092,000 over that 12-months period.

Picture sourced from www.reinz.co.nz

Leverage - given the regulatory risk assessment of residential real estate, banks are willing to lend a lot more on residential houses than against most other assets. At the time of writing (August 2020), most NZ banks were lending up to 80% against residential properties. Therefore, to purchase a $1m house, you only need $200K as your deposit and the bank would lend the remaining $800k, subject to meeting other lending criteria.

How does leverage work?

Suppose you bought a $1m investment property with $200K cash and $800K bank loan. Also for simplicity let's assume that the annual rent from the house exactly meets all the financing and operating cost, i.e. cashflow neutral.

Now, if in a year's time this house goes up in value by say, 9.2% and is worth $1,092,000, then the return on YOUR cash investment (return on equity) is:

92,000 / 200,000 = 46%.

This is 5x the assumed annual house price return in this example and a lot more than what most other investments currently offer.

Control - most investors are able to purchase the whole property by themselves, without the need for any equity sharing with other external shareholders. Therefore investors have full control over what they want to do with asset and how they want to run their 'rental business'. You want to paint the wall? Install a heat pump? Advertise on Trade me? Go ahead do it. This is quite different to investing in financial assets such as buying shares, where unless you are on the Board of Directors, it is quite difficult to drive the decisions made regarding the business.

Disclaimer: The content of this blog or anything else on our website contains general information only and it should not substituted for financial advice or specific advice. R&D Accountants and Analysts (RDAA) Ltd do not accept any liability whatsoever relating to losses or damages arising from reliance on the contents of this blog or anything else on our website.

RDAA Ltd strongly recommend that before a reader undertakes or implements any financial, investment, taxation or business decision flowing from information or content of this blog or anything else on our website, they procure professional advice from a suitably qualified adviser, on which they may rely on their specific opinion. Such advice should be comprehensive in character and appropriate to the individual's personal circumstances and financial affairs

Comments